HOURS: 8:00am – 5:00pm Monday-Friday

Rhonda Zubke, Day County Treasurer

711 W 1st Street, Suite 206

Webster SD 57274

(605) 345-9510

Fax (605) 345-9511

[email protected]

Barb Niles, Deputy Treasurer

Sheila Schimmel, Deputy Treasurer

Real Estate Taxes

The Treasurer, as the tax collector is responsible for collecting all property and mobile home taxes for the county, cities, school districts, sanitary districts, and any other political district authorized to levy real estate taxes.

Real estate taxes are paid one year in arrears. (Example: In the year 2019, property owners will be paying 2018 real estate taxes.) Real estate tax notices are mailed to property owners in January. The first half of taxes are due by April 30th and the second half are due by October 31st—all taxes under $50.00 and any special assessments are due in full by April 30th.

2024 MILL LEVIES

(2024 taxes are payable in 2025)

Motor Vehicles

The Treasurer’s office titles and licenses all new and used motor vehicles, motorcycles, trailers, snowmobiles and boats. Our office also records and releases liens placed on vehicles.

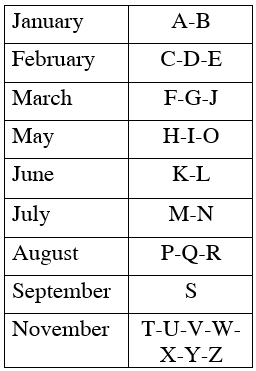

Registration of commercial and non-commercial vehicles, trailers, motorcycles, ATV’s, snowmobiles, and boats are done on a staggered licensing system based on the first letter of the owner`s last name, or in the case of a business, on the beginning letter of the business name.